Pro-forma

Cash to Close | $33,250 |

Monthly Payment | $3,600 |

Income | $2,300 |

Income | $1,700 |

Income (moved-out) | $3,400 |

YR 5 Equity Position | $158,000 |

3 Plano duplexes in high demand East Plano at $475k, fully remodeled. Identical 2 bed 2 bath roughly 900 sqft units that should lease quickly around $1,700 in a market that rarely struggles for tenant demand. This is more of a quality and location play than a deep discount play. Live in numbers are not sexy day one, but long term hold in Plano with updated product is rarely the wrong bet.

*deal of the day*

Pro-forma

Cash to Close | $17,000 |

Monthly Payment | $2,000 |

Income | $1,600 |

Income | $1,000-2,000 |

Income (moved-out) | $2,600 |

YR 5 Equity Position | $62,000 |

Fort Worth SFH plus ADU at $250k is exactly the kind of starter setup that gives you options instead of pressure. Live in the ADU and rent the main around $1,300, live in the main and lease the ADU long term or mid term from $1-$2k/mo+, or keep it as office /guest space once you are done house hacking. Small footprint but smart layout and location, low entry price, and real income potential without taking on a monster mortgage. Killer deal!

Pro-forma

Cash to Close | $42,000 |

Monthly Payment | $4,800 |

Income | $3,500 |

Income | $2,400 |

Income (moved-out) | $4,800 |

YR 5 Equity Position | $197,000 |

Richardson full duplex hiding in plain sight at $595k. This one will not show up in a lot of multifamily searches because it was listed as a single family half duplex, but it is in fact a rare full duplex in Richardson ISD. Fully remodeled 3 bed 2 bath units that rent around $2,400 per side. One side is move in ready and the other is leased for immediate income. Higher entry point, but strong school district, clean renovation, and true side by side layout make this a long term hold type asset in a high demand / low supply pocket.

Pro-forma

Cash to Close | $49,000 |

Monthly Payment | $5,000 |

Income | $4,300 |

Income | $3,000 |

Income (moved-out) | $6,000 |

YR 5 Equity Position | $245,000 |

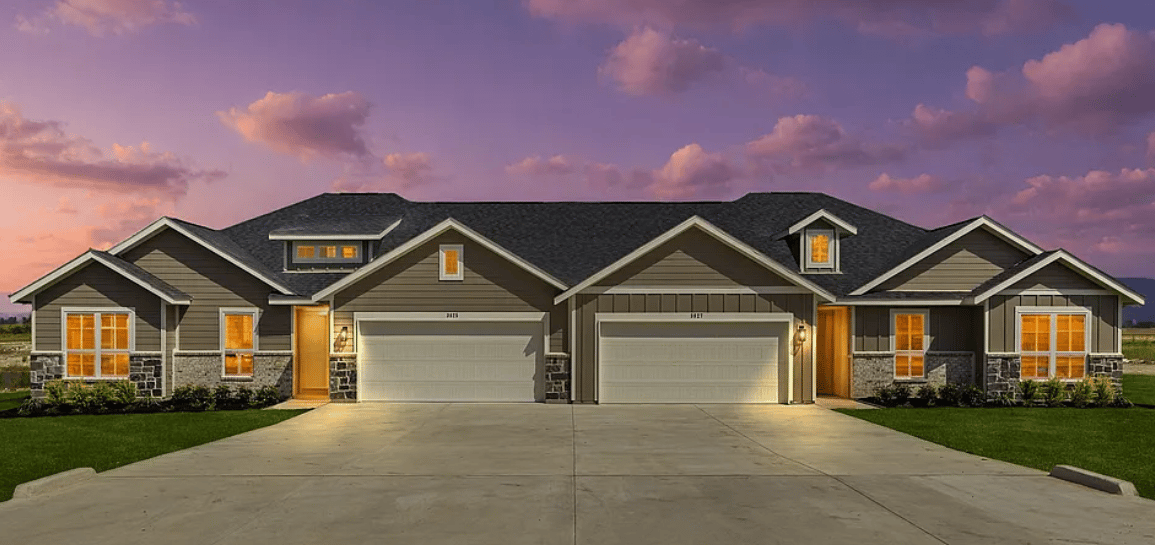

Luxury new construction duplex in Midlothian priced at $700k with 4 bed 2 bath 2 car garage layouts on each side that should yield ~$3,000/month per unit and a rare 4.25% permanent rate buydown available through a preferred lender. Higher entry for a starter home buyer, but this is clean, zero capex risk housing in the direct path of long term south DFW growth. Live in one side with a modest net monthly cost for the asset class. This is a long runway hold that can quietly compound for a decade without the usual upkeep or tenant-turnover headaches.

Pro-forma

Cash to Close | $39,000 |

Monthly Payment | $4,600 |

Income | $3,200 |

Income | $2,000 |

Income (moved-out) | $4,000 |

YR 5 Equity Position | $184,000 |

2018 build in Midlothian with 3 bed 3 bath per side opening up the option for 2 roommates in owner-occupied unit each having their own bath. Strong $2,000 per unit rent potential upon move-out. Clean, low capex asset in the path of growth. Main hurdle is lease timing since both sides are tied up through 2026, so you would need a clear primary occupancy plan written into the contract (adjusting 1 lease to month to month or serving a notice to vacate within 60 days of closing). Structurally strong deal, just requires patience and good execution.

Pro-forma

Cash to Close | $20,000 |

Monthly Payment | $2,400 |

Income | $2,000 |

Income | $1,200 |

Income (moved-out) | $2,400 |

YR 5 Equity Position | $102,000 |

Classic Sherman duplex one block off the hospital in the middle of “Silicon Prairie”. Clean 2 bed 1 bath units with leases in place around fair market rent, Nothing flashy here, just a stable asset in a strong corridor where timing owner occupancy around the early/mid 2026 lease expirations is the main moving piece.

More Deals We Like:

• 4212 Geddes Ave – Fort Worth

Alamo Heights pocket, SFH + guest house with separate meters (rare). Big-ticket updates done, strong resale profile, guest unit already leased at $600 and wants to stay.

• 921 Cody Ct – River Oaks

Turnkey duplex near Lockheed Martin. One side fully updated, the other leased long-term at $1,445 - optimize by renewing leases with quality tenants before pushing rent and risking vacancy.

• 107 Sewell Ave – Midlothian

Cute as a button $315k turnkey main + guest house. Great entry point and condition for the downtown Midlothian market.

• 708 Seven Oaks Rd #712 – Bonham

2019-built duplex in the Sherman tech ripple zone. Corner lot, separate drives, price cut from $279k to $245k, one tenant already in place at $1,125. STILL MY FAVORITE HOUSE HACK OPTION (if this is your neck of the woods:)

• 300 Benjamin St – Denton

$45k price drop on a Denton duplex. One side leased at $1,600, large 3/2 layouts ideal for the roommate strategy as well. Denton/NFW growth tailwinds remain strong.

• 3536 Suffolk Dr – Fort Worth (TCU)

Motivated seller sign after a $50k cut. SFH + ADU with dual master suites, huge yard, ideal rent-by-the-room or live-in-one-rent-the-rest setup.

• 1705 La Salle Dr - Sherman

$300k clean 2 story 2 bed units. Simple live in now, solid long term hold later. Only friction is coordinating one lease for owner occupancy timing, very common and very workable with the right contract.

Until Tomorrow,

John